The forex market is a non-stop cash market where currencies of nations are traded, The forex market is one of the world's largest trading platforms available. Foreign currencies are simultaneously bought and sold across local and global markets, hence the value of currencies appreciate or depreciate in value based upon their movements. Forex Trading is not restricted to a trading floor and is not centralized on an exchange like the stock market. The Forex market is an Over-the-Counter (OTC) or 'Interbank' market, because the entire market is run electronically, within a network of banks.

|

| Forex Trading |

Attractions of the Forex Market:

The main attractions of currency dealing to private investors and attractions are:

1. 24-hour trading, 5 days a week with access to global forex dealers.

2. A highly liquid market making it easy to trade currencies.

3. The ability to profit in rising or falling markets.

|

| IMAGE |

Leverage trading with low margin requirements.

How Forex trading is done:

Forex trading is always done in currency pairs. Trade only when you expect the currency you are buying to increase in value in comparison to the currency you are selling. If the currency you are buying does increase in value, you must sell back the other currency in order to get a profit. The person that bought or sold the currency has no plan to take actual delivery of the currency and they were speculating on the movement of that particular currency. More than half of the forex market is speculative. The investor's goal in forex trading is to profit from foreign currency movements

|

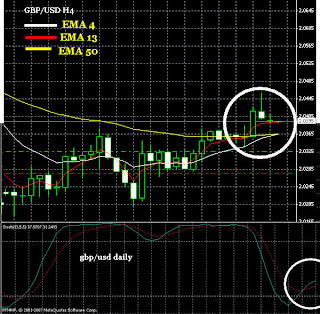

| Garph Forex |

|

| Forex Trading |

Exchange rate of currencies

Currencies are traded in pairs in the forex market and exchanged against another when traded. The rate at which they are exchanged is called the exchange rate. Most of the currencies are traded against the US dollar (USD). Major currencies traded in the Forex market: The major currencies are:

1. USD - United States Dollar

2. EUR - Euro members Euro

3. JPY - Japan Yen

4. GBP - Great Britain pound

5. CHF - Switzerland franc

6. CAD - Canadian dollar

7. AUD - Australia dollar

Types of investors in the Forex market: There are 2 types of investors involved in the FOREX market.

1. The hedger: The hedger is involved in International trades and uses FOREX trading to protect his interest in a transaction from currency fluctuations.

|

| Trading Foreign Forex Exchange |

|

| Forex PipStack |

|

| Make Money |

|

| Forex Graph |

|

| Forex View |

|

| Intro Of Forex Trading |

2. The speculator: The speculator is the type of investor who invests in currency only for profit motive.

Risks involved in Forex trading: As compared to other ways of trading like the stock and futures areas, forex trading is less risky and more profitable. This is because there is no central area where traders are forced to work from. It operates around the clock and there is always somebody available to take an order. Although Forex trading can lead to very profitable results, there are risks involved like exchange rate risks, interest rate risks and credit risks.

No comments:

Post a Comment